$DAWN - Day One Biopharma writeup

Summary

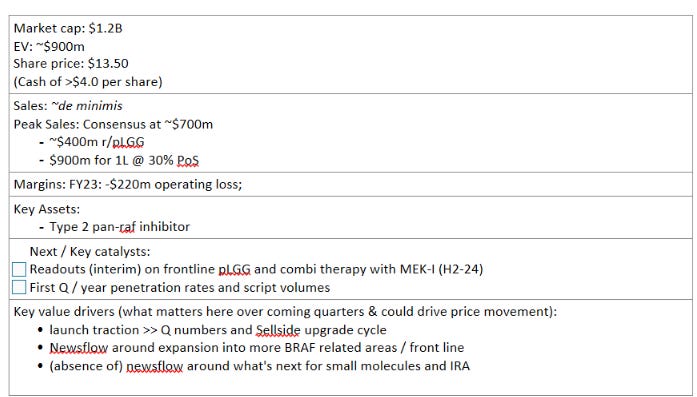

TLDR

A commercial-stage $1B market cap company with a new drug launch underway

Market has the current product penetration rates / PoS on future indications wrong

Positive sales momentum on the new drug approval and positive frontline data will lead to earnings upgrades and re-rating of the stock within a year as there is a nice systematic catalyst pathway / route to value

It's a nice bet. 100-200% upside, 50% downside

Situation overview

Ojemda was approved in April 2024 in patients 6 months and older with relapsed or refractory BRAF-altered pediatric low grade glioma (pLGG)

But stock is down 40% since IPO; and it has been a pretty wild ride (low of 5, peak of 27)

I have owned some OTM call options (IV was fine at the time) and now looking at whether to cut it or size up as it has bled about 5% YTD

It seems to be a bit of a hypey name I've seen among twitter retail but limited specialist involvement, so one to triple-check & pinch yourself on ("what're you missing")

However, there is a clear catalyst path i.e. the Ojemda approval and launch in relapsed=> pivotal study in 1L => readout from combo study with pimasertib (MEK inhibitor) => other indications

Opportunity and why it exists

There is an opportunity to make money here. There is likely a floor at bout ~30-40% below from where we are here and a chance to do a double or triple on your money.

It seems the market is underappreciating the opportunity with the already approved indication (relapsed); I think this alone is enough to underwrite a current valuation on unheroic assumptions (max penetration of ~700 annual patients). Then you make money depending on whether it can 1) outperform my assumptions; 2) score a transition to 1L and 3) achieve indication expansions over time

There are sufficient upcoming catalysts to shift market views on this within the year; and so far there is +ve whisper about launch

Early progress can be monitored through feedback on script volumes and switch from EAP programme to the commercial drug (note: specialty pharmacy so don’t have the actual script data)

The science is solid and the data around efficacy, tolerability and convenient formulation mean it has +ve feedback from KOLs

In summary: attractive up down risk and catalysts mean we figure it out quite soon. Will want to see sales traction and positive frontline data for the thesis to play out.

Background

Company history

Its a Canaan, Atlas and Access backed project which launched with a $60m series A in 2020

Canaan incubated it with Dr Sam Blackman, and seeded the tech with acquisition of the rights to DAY101 from Takeda (formerly TAK-580)

In 2020 appointed jeremy Bender as CEO, ex-Gilead head of Corp Dev and previously at Sutro & Tizona

Appraising Management

(+) They've done an insane job here going from company inception to approval in 4-5 years - chapeau🎩 .

(+/-) You could argue they got lucky (i.e. the drug already had data from 200 adults in melanoma and lung cancer and became available at the perfect moment when Takeda did demerger from Shire); and you could argue that they are good in the clinic, and we have no idea yet about their commercial execution.

Appraising the core 4:

Growth

(+/-) It is TBD - but peak sales estimates from street are >$1B and we have one approved; and the frontline + MEK data pending with high PoS (probability of success)

Could miss on short term data; don't feel I have a strong enough edge on that to try and express it. Sell side has $17m of sales this year. I think this likely comes from assuming a 100% conversion from the n=42 on the EAP (expanded access programme)

Margins

(++) Small molecule drug in a well defined sub-population of clinicians they need to reach, with very motivated patient parents. This has all the hallmarks of high GM, low sales & marketing intensity business. I think this is a 50%+ core EBIT type of business w/ high FCF conversion;

(-) Expect some dilution from continued R&D spend on alternative programmes; but they seem focused

Capital intensity

How will they do manufacturing?? Might be low to no capex but sacrifice on GM >> Seen CMC hiring on linkedin so channel check that

Capital allocation

(+/-) Put some of the capital raised to work on in-licensing new therapies;

(+) Have "raised well" on data etc and also recently sold their priority review voucher for $108m - it seems like a prudent move

(+) Am impressed by the indication-focus to date; and even the addition of the MEK inhibitor seems capital efficient

(-) It's a US company so cue the typical wall of SBC dilution over time

Financials

Not meaningful operational data to read-thru

(+) They have $360m in cash so well capitalised for now; and currently main spend item is $40m of quarterly R&D & $25m of G&A)

About the disease

Pediatric CNS tumours have incidence of about 50k per year globally (https://cbtrus.org/wp-content/uploads/2022/05/CBTRUS-Pediatric-Factsheet-2022.pdf)

Pediatric low-grade gliomas (pLGGs) are the most common brain tumors in children, accounting for approximately 30% of all childhood central nervous system (CNS) tumors in the United States (US)

Gliomas / astrocytomas are a set of lesions and molecularly quite heterogeneous; including juvenile pilocytic astrocytoma (JPA), the most common low-grade tumour in children, which usually grows in the posterior segment / cerebellum; it makes up 20% of pediatric brain tumours

Other low grade include tectal glioma, oligodendroglioma, ganlioglioma, pleomorphic xanthoastrocytoma, pilomyxoid astrocytoma

Long-term survival for patients with pLGG is favorable, with a 10-year survival rate of 95% for pilocytic astrocytomas and 86% for other LGG subtypes reported in the US

glioblastoma multiforme (GBM), a high-grade tumour that is usually superior / supratentorial; anaplastic astrocytoma, a high-grade tumour that usually grows in the upper part of the brain

Diffuse midline gliomas (aka diffuse intrinsic pontine gliomas) - associated with the brainstem. Makes up 10% of all brain tumours

About 60% of brain tumors in children occur in the infratentorial brain (cerebellum and brainstem). They can also occur in the supratentorial brain

Common mutations

BRAF is the gene most commonly altered in pLGG, of which there are two primary types – BRAF gene fusions and BRAF point mutation.

~70% of all pediatric low grade gliomas have BRAF fusion alterations (most commonly KIAA1549-BRAF fusion) / ~17% have V600E point mutation

In KIAA1549-BRAF fusion protein alterations, rearrangement results in the N-terminal regulatory domain of BRAF being lost, leading to downstream constitutive up-regulation of the RAS/MAPK signaling pathway; and so far 5 separate exon-exon junctions have been described, which all lead to loss of BRAF's regulatory domain

KIAA1549-BRAF fusion is more often associated with pLGGs, and 70% are detected in pilocytic astrocytoma, which is usually located at the posterior fossa and cerebellum

BRAF V600E mutation is a point mutation, in which valine at position 600 is replaced with glutamic acid, BRAF V600E mutation is a common mutation that occurs in many types of cancers, such as colorectal cancer, papillary thyroid cancer and melanoma. Although this mutation has been reported in adult and paediatric gliomas, it is rarely found in adult gliomas

BRAF V600E mutation has been detected in pilocytic astrocytoma, ganglioglioma, diffuse astrocytoma and pleomorphic xanthoastrocytoma

V600E can occur anywhere in CNS and >33% occur in the brain, in the midline

Other common mutations

NF1 common germline mutation that functions as a negative regulator of RAS; 10-15% develop low grade glioma w/ optic pathway involvement; most are asymptomatic and indolent (Note: excluded in trials; is upstream of Raf in MAPK pathway)

FGFGR

NTRK

RAF1

ALK / ROS (Also MAPK pathway)

MYB / c-MYC / IDH-1 / H3F3A (Non-MAPK pathway)

The opportunity set: According to the company

The total TAM for pediatric low grade gliomas (pLGGs): circa 26k patients as a prevalent pool of BRAF altered PLGG patients who have been treated systemically at some point .

Addressable market of 2-3k patients who at any point is on an active systemic therapy in the US, and have PLGG & a RAF alteration

Approx 1.1k PLGG patients a year is the incidence number they cite that have BRAF change in the tumour

MY COMMENTS:

The more well circumscribed and clearly demarcated, the more amenable to surgery; so is TAM the true TAM; the most common form i.e. pilocytic is commonly well defined, and that is 70%

And there is some broker feedback that certain docs will see this as a definite yes in V600E but a watch and wait in BRAF fusion. Can always bet on clinician conservatism.

Disease course:

The typical effects of a space occupying lesion: morning headaches, nuasea & vomiting, vision, balance & coordination.

The common impacts depend also on site of tumour eg. Cerebral hemispheres vs cerebellum v brain stem v optic nerves

For reasons not fully elucidated yet, once pediatric patients enter their 20s, most pLGGs stop growing spontaneously and never grow again;

Grading

Driven by histology commonly, which in turn impacts mitotic profile (i.e. speed, aggression)

Treatment

Until recently, for most of these slow-growing tumors there were no approved targeted therapies; the main treatments being surgical resection and chemotherapy. Prognosis for these tumors is good, with 10-year overall survival rates of 85-96%.

However, PFS is ~50%; which means the other 50% require adjuvant therapy

Survivors are therefore at higher risk of suffering profound side effects from both the tumor and the treatment, which may include chemotherapy and radiation.

e.g. hearing loss, immune compromise, infertility, tumorigenesis, carboplatin hypersensitivity

Despite this, pLGGs remain understudied and underfunded relative to adult low-grade gliomas and relative to other rare but more aggressive pediatric brain tumors

Standard of care:

Most children require long term treatment - and it is viewed as a chronic indication that needs to be managed long term

Active Management of pLGG and the key decision tree relates to possibility of surgical resection vs not. Complete resection remains the most favorable predictor of patient outcome

However, while this can be achievable for superficial lesions (hemsipheric or posterior fossa); it is not feasible for highly infiltrated and diffuse lesions. In which case treatment involves adjuvant chemo or radiation, which have long term sequelae

The chemotherapy agents that are currently used in treating high-grade gliomas are vincristine, carboplatin, temozolamide, lomustine, vorinostat, bevacizumab and irinotecan

Vincristine is well tolerated (1-2% AE); whereas carboplatin ~25% develop a pretty serious anaphylactoid reaction; also increased risk of hearing loss and renal damage; and need steroids; temozolamide impacts bloods and is long term risk factor for secondary cancers

To date, patients struggling with the Rx will then be put on MEK inhibitors which cause acne / rashes (but low grade / not a show stopper) in majority of patients; and rarely visual issues; they also need regular cardiac monitoring due to risk of heart failure

Well / poorly met need?

(+) Poorly met >> Kids not seen as being the best business opportunity in pharma (smaller markets, hard to recruit for trials, academic centers who treat are difficult, children likely to have long term side effects from treatment i.e. downside risk)

Since 1980 only 8 drugs developed for pediatric oncology; even as incidence has increased 24% since then

Radio and chemo-therapy have unpleasant side effects, even if OS is good

Despite good OS, the recurrence rates are high

The data

(+) RAPNO LGG overall response rate (ORR) of 51% )(see below)

The drug:

OJEMDA (tovorafenib) is a type II RAF inhibitor (and wild-type CRAF kinases), for the treatment of patients 6 months of age and older with relapsed or refractory pediatric low grade glioma (pLGG) harboring a BRAF fusion or rearrangement, or BRAF V600 mutation

It is taken once weekly as a tablet or suspension

It received accelerated approval based on data from the Company’s pivotal open-label Phase 2 FIREFLY-1 trial

As a reminder

RAF is involved in the key MAPK pathway downstream of GRB2 (RAF/MEK / RAS/ ERK etc) important in mitogenic activities

Once RAS is active, it will bind to RAF (Rapidly Activated Fibrosarcoma). RAF is normally created bound to an inhibitor protein called 14-3-3. This 14-3-3 protein actually gets used a lot in pathways to inhibit different proteins. 14-3-3 is bound to RAF blocking its active site so it can not be activated. When RAS binds, it changes the shape of RAF allowing several other proteins to remove the 14-3-3 and activate RAF by phosphorylating it. The first is PP2A (Protein Phosphatase 2A) will remove the 14-3-3 from blocking the activation site. This allows for the phosphorylation of the RAF protein. This allows the RAF to become active.

One of the most common forms of RAF is BRAF which plays a huge role in Melanoma.

This is the BRAF V600E substitution mutation. This drives cancer growth.

Pan-raf drugs are commonly known for their potential / role in melanoma. They were viewed as a significant breakthrough. However, the checkpoint inhibitors superceded them and they have become more overlooked.

What about competition?:

Tovorafenib is an oral small molecule, type II pan-RAF inhibitor that, in contrast to type I inhibitors, does not induce reactivation of the MAPK pathway / paradoxical ERK activation. Thehe gene alteration brings about expression of a wild type BRAF catalytic domain without normal regulatory domain, which renders BRAF constitutively active. Current type 1 RAF inhibitors are only able to treat BRAF V600E activating point mutation (5-17% of all pLGG)

(+) The Type I RAF inhibitors have had meaningful uptake in their relevant indications.

(+) Direct competition in pLGG

None approved for now

Indirect - type I Raf inhibitors

Most pan-RAF inhibitors are indications with large end markets (melanoma, NSCLC, CRC)

Roche has a pan-RAF inhibitor (Belvarafenib)

Novartis has Tafinlar (Dabrafenib), indicated in BRAF associated MELANOMA / BRAF mutant cancers like NSCLC and often used in combi with mekinst (MEK inhibotor); it selectively target BRAF kinase and thus interfere with the MAPK (mitogen-activated protein kinase) signalling pathway that regulates the proliferation and survival of melanoma cells (mitogen activated)

(-) It is also indicated in BRAF V600E gene mutant +ve pediatric glioma (~15% of SAM)

COMPETITION

Overall: relatively benign competition landscape (+)

Competitive Pricing:

$33,916 for a 28-day supply, which translates to an annual cost of >$400k

(-) Tafinlar & Mekinst (both about $2B in annual sales) are priced at about $80-90k each, so cheaper

(-) darafenib & vemurafenib also about $9-10k per month

The Meat

So What is the DATA showing:

Summary:

(+) Short term data: looks good enough to positively impact prescriber and payor behaviour

Long term data : Not yet available. But what does good look like?

Long term OS data is comparably better than the 87% (note: this will be HARD to achieve as it is already so good)

Recurrence rates are significantly better (this will be easier, as 50% have a recurrence)

Patients NOTICE this, as well as more favourable side-effect profile of the drug vs chemo and radio >> report good feedback and actually take the drug

Rest of the pipeline:

The pivotal Phase 3 FIREFLY-2/LOGGIC clinical trial evaluating tovorafenib as a front-line therapy in patients aged 6 months to 25 years with pLGG continues to enroll in the United States, Canada, Europe, Australia and Asia, with more than 80 sites activated.

An open label, P3 vs investigator choice of SoC chemo over 60 months

Measuring ORR assessed by RANO-LGG

(-) NOTE: this is not investigating tovorafenib vs MEK inhibitors; whilst not unexpected, it is a little disappointing and might impact clinician behaviour

Licensed the MEK-inhibitor, pimasertib, from Merck KgAA in 2021:

MSC2015103B is an ATP-non-competitive, allosteric inhibitor of mitogen-activated protein extracellular signal- regulated kinase kinase (MEK). MSC2015103B has been studied in a Phase 1 dose escalation trial in adult subjects (n=28) with advanced solid tumors. A once-weekly (n=21) and three-times-weekly (n=7) dose schedule were studied. Overall, the most common treatment-emergent adverse events reported (in > 40% of subjects) were fatigue in the Schedule 1 group; and constipation, nausea, hyponatremia, and hypokalemia in the Schedule 2 group.

Patient enrollment continues in the Phase 1b/2 substudy (FIRELIGHT-1 trial) evaluating the combination of tovorafenib with the investigational MEK inhibitor, pimasertib in patients with recurrent or progressive melanoma or other solid tumors with alterations in the key proteins of the MAPK pathway

Now also has an ADC programme targeting PTK7 in solid tumours which will start P1 in begin 2025. PTK7 is involved in the Wnt signalling pathway dysregulation is common in colorectal cancers. In the company materials they mentioned ovarian / TNBC / NSCLC

Commercial considerations:

(+) It's high ticket and treatment is long duration.

Also compared to SoC it is XX

Will prescribers prescribe?

(+) What's nice is that the pediatric oncology doc subset is well defined and reachable

(+) Sentiment is positive according to DAWN >> 89% of target physicians are aware of Ojemda, of which 65% have already noted an intent to prescribe (likely to be those who prioritize novel therapies and recognize Ojemda’s strong value proposition

(+/-) the KOL feedback I've seen suggests that prescribing in V600E mutant cases is a shoe-in (20% of BRAF); but it is less certain in BRAF fusion patients where they have experience with the off-label drugs (NVS' trametinib / dabrafenib)

Will patients take:

(+) Formulation is preferable >> tablet or suspension; and once weekly

Other agents like salumetinib and trametinib are BD and OD i.e. quite burdensome for the patient and caregivers

Distribution?

Via spec pharma > no surprise there, but a marginal (+)

Precision Oncology?

(-) Molecular onc is a barrier to diagnosis and therefore treatment, and therefore often seen with lower enthusiasm by investors (particularly if it is included in the label i.e. like here)

How do I feel about their sales competencies?

(-) Linkedin hires >> company preso stated 18 Account managers on staff; only seem to be 5 recent hires currently on linkedin marked under the 'sales' keyword and they are mostly all senior / have been poached from Genetech; I am waiting to see if they have sufficient boots on the ground, but there seems to have been no hiring ramp post approval

(-) They will have competition from the MEK-inhibitor lot (NVS); and from physicians-own conservatism >> an endorsement from Clinical Oncology group or guideline publication will have a bigger impact than AM-presence

Reimbursement

(-) There is possibly some downside risk on pricing in outer years > it is estimated that patient mix is 60% commercial insurance, 40% Medicaid

(+) They have already secured ~90% coverage of patients

How to value this:

What's currently priced?

I have the market pricing peak penetration of 700 treated patients a year, which gets you to $600m peak sales / @45% EBIT and 75% cash conversion / 11% WACC / with outer year price cliff decreasing pricing you from $400k to $50k upon genericisation.

Said differently - most centres have about 40-50 patients, so it would mean "converting" a grand total of 14 centres across the US / the world. 😐

Valuing the stock?

Under a scenario where they do get positive data in frontline (we also already know that some physicians will / are prescribing it anyway) and addressable market expands to 3-4k; even assuming the a 65% max penetration, we get to an EV of $3B. That's 2k patients per year folks.

There are all sorts of other ways you value this (x sales multiple, takeout value as multiple of 4-5 year peak sales estimate), but a straightforward and reverse DCF is my preferred.

This is one of those where it's hard to square away current valuation.

Other programmes

Patient enrolment continues in the Phase 1b/2 substudy (102b) of the FIRELIGHT-1 trial evaluating the combination of tovorafenib with the Company’s investigational MEK inhibitor, pimasertib

The pivotal Phase 3 FIREFLY-2/LOGGIC clinical trial evaluating tovorafenib as a front-line therapy in patients aged 6 months to 25 years with pLGG continues to enroll in the United States, Canada, Europe, Australia and Asia, with more than 80 sites activated.

Optional/ dare to dream scenarios:

There are multiple other high grade gliomas which are also BRAF mutants eg. High-grade astrocytoma with piloid features; Pleomorphic xanthoastrocytoma, Diffuse leptomeningeal glioneuronal tumor, Ganglion cell tumors, Papillary craniopharyngioma

Many of these are rare so there may be a relatively quick path to approval; or alternatively, you could see doctors prescribing it off-label anyway (as we hear is already the case in lg gliomas. Insurers have apparently been reimbursing for some of this anyway)

Day-one becomes the de facto RAS/RAF/MEK/ERK company in multiple indications

What is Sentiment / where is the buyside:

It's been a slow bleed on PnL; with volume of 47k shares changing hands daily;

That sort of slow, low volume bleed is always a bit annoying, but also not surprising post-key approval date. I think buyside are likely in a watch and wait type of pattern and people probably start doing some real work on the name towards Q4 this year. Given the sandbaggy comments on the approval call, you possibly have a bunch of folks who put the pen down on further work. It’d be a tough short and might not feel like one where the juice is ready to squeeze.

HDS:

Atlas is still a long term holder as well as some other larger L/O type of institutionals.

(+/-)But specialist biopharm hedge funds are notable by their absence. I can only see general healthcare HFs like Viking and Braidwell - and for these guys it would also be a miniscule % of AUM.

Indicators for sentiment:

(+) Short interest: low (but unsurprising as 11 days to cover)

(+) Option implied pricing: 65% IV / ATM straddle-implied moves

(+/-) Price action: there HAVE been some moves to the upside of late /moved above certin moving average levels; so at least it's not downtrending

(+/-) volume: still quite low

Thoughts on how the buyside view this

(-) This is likely not viewed as a must-own asset

Not in any key spaces like ADC/engagers, Radiopharm etc. You just need an allocation here

A small end market

Not viewed as a platform within a product

Unclear M&A exit

(-) It's also possible that the requirement for a molecular diagnostic profiling is viewed unfavourably (although is is standard of care in peds CNS)

(-) On the M&A side, I can't imagine NVS haven't had a very hard look and are happy with their own product and pipeline. So this needs to be for one of the other members of the MAPK pathway competition for whom this is a fit, or perhaps someone else who has distribution into this end market (again probably NVS via alexion, or maybe Sanofi via its rare diseases. But it seems doubtful tbh, as the clinician subset is entirely different, and ).

(+) Otherwise its possible its just a large onc player like Roche - most of the team seem to be Genentech anyway.

To generate a bit of fizz for this name, I think we need to see some execution on sales leading to sell side upgrades; and then I'm not surprised they brought in this ADC programme. I don't see the clear rationale, but let's see.

What's the trade:

I'll top up call options. IV is actually fine relative to itself for this stock; and versus other biotech

What's the trade after the trade:

Even though I like this for the long term - I'd still want to trade this rather than simply buy-n'-hold

So on a 50%+move I'll take it down, if that happens

Where would I be wrong here:

Short term

sellside could be too aggressive on the immediacy of the launch, so may need to be prepared for a topline miss in Q2 / Q3 and potential near year estimate downgrades. Even if I like the long term thesis, that would be negative for the stock

I'd even argue that management sandbagged the launch already - they said "not to expect a bolus of patients…we haven't heard of product warehousing…or patients lining up through the door." So we cannot expect any sell-in / inventory build in first Qs.

Secondly, some physicians say that the nature of how they treat this means you wouldn't just stop systemic therapy and convert. So it will have to be NEW relapsing patients at each time. That means a slower ramp

Long term

20 year OS is good for pLGG - at 87% >> do patients, prescribers and payors actually want this?? Especially priced at this level. And does this translate into near term scripts.

The addressable market values and penetration levels are incorrect: Company claims 1.1k patients have a BRAF change in the tumour and ~ 50% progress / relapse >> this may be lower, and some physicians say it is lower than this number (4-5k pediatric tumours per year, 1k low grade, of which a 30-50% recur; of which probably 70% have the BRAF mutation)

Competition > for type 2 inhibitors there isn't much right now, but there are several type 1s from much larger commercial organisations; NVS's product is already approved and prescribed to V600E mutant patients

Unknowable safety signals >> that is part of the game; none I am especially worried about so far - but AE should always be taken seriously, particularly in a condition where OS is good. The slightest reduction in living standards, and patient compliance may drop

Efficacy not as good - that's also the game we are in. So far I think the data is good and there is a margin of safety, but we are basing this off ORRs on imaging data. How does this really impact patient survival and living?

Market understands the opportunity but just doesn’t care and isn't willing to pay up for niche indication product companies that don't have broader appeal

Conclusions:

It is underpriced and has a place in my portfolio

Feel much happier about it now I have done the work and will take it up a few % as part of the allocation; and buy on any unexplained weakness

Sources:

https://www.sciencedirect.com/science/article/abs/pii/S1878875023012585

https://cbtrus.org/wp-content/uploads/2022/05/CBTRUS-Pediatric-Factsheet-2022.pdf

https:/www.ncbi.nlm.nih.gov/pmc/articles/PMC9846085/#B54

https://www.oncolink.org/cancers/brain-tumors/all-about-pediatric-gliomas-low-and-high-grade

https://www.pathologyoutlines.com/topic/cnstumorwhograding.html